Invest in Bitcoin mining

Without worrying about bureaucracy and the operational part, but in an intelligent, safe, and profitable way!

What is AMT?

The democratization of BTC mining

How does AMT work?

The mined bitcoins are distributed to 3 wallets:

The history of AMT

AMT is composed of Latin American investors who started mining Bitcoin in 2018, in Paraguay.

Is the AMT system secure?

Yes, AMT is 100% backed by Bitcoin and terahash. We have mining facilities in Paraguay, and you are welcome to visit us.

AMT has a liquidity of approximately 80 BTC, of which 50% are locked for 2 years.

We don't work with platforms or cloud mining, we don't have a referral system, and we don't hold investor's funds.

The investor's token always remains in their wallet or in a staking smart contract, which has already been audited by Hacken and Solidity Finance.

Roadmap

Project execution begins. Token analysis and planning.

Website and White Paper publication. Audits conducted. Contract with miners established.

Liquidity pool creation. Official token launch. In-person event in Bal. Camboriú/SC.

In-person event in Foz do Iguaçu/PR. Purchase and connection of new machines.

Listing on CoinGecko. Purchase and connection of new machines.

Great Reset: increased profitability of the AMT token.

Launch of a web3 game - Trading Challenge

Launch of an application for P2P buying and selling of cryptocurrencies.

Launch of a Web3 game - Bitcoin mining simulator.

Tokenomics

The AMT Project aims to increase the distribution of bitcoins to the Growing Liquidity Reserve without reducing the distribution of profits to investors. To achieve this, the profits from the upcoming machine acquisitions will be directed towards supplying the Growing Liquidity Reserve. As a result, the AMT token will have an increasingly higher minimum price, which translates to greater security for investors.

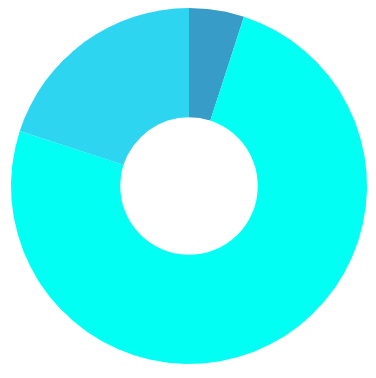

Operating Costs: 75%

Investor Profit: 21,5%

Growing Liquidity Reserve: 3,5%

Sales in the foreign market: 20%

Miners: 75% (locked tokens)

AMT Group: 5%

Total supply: 100,000,000

Launch date: 09/17/2022

252 AMT = 1 TH/s: This ratio was 625 AMT = 1 TH/s at the beginning of the project. With the project’s development and the purchase of new machines, the ratio will continue to improve.

Ticker: AMT

Network: BNB Smart Chain (BEP20)

Contract Address: 0x6Ae0A238a6f51Df8eEe084B1756A54dD8a8E85d3

Growing Liquidity Reserve (GLR) Smart Contract: 0x759ab9e6BCc85feeF36aF26d2529C31d684A06d6

Click here to check the daily and automatic distribution of BTC to the Investor Profit wallet and to the GLR wallet.

About Us

Our mission is to democratize bitcoin mining.

Connect with us

Our social media platforms

FAQ

Frequently Asked Questions

AutoMiningToken (AMT) is a native token on the BNB Smart Chain network with a mission to democratize Bitcoin mining. The AMT Project aims to make it possible for anyone to invest in Bitcoin mining without the need to worry about the bureaucratic and operational aspects of the business. This becomes achievable because AMT is the result of tokenizing a Bitcoin mining ecosystem located in Paraguay, backed 100% by Bitcoin and terahash power. The tokens can be likened to partitioned ASIC miners, and the more tokens an investor holds, the greater their terahash power, resulting in higher Bitcoin earnings.

We specialize in issuing tokens backed by bitcoin and terahash. Basically, “tokenization” is the transformation of a real asset into a digital asset, fragmented into encrypted units (the tokens). These tokens are created in such a way that they can be subdivided, traded, and stored in decentralized accounting technology (DLT). In this case, our token (AMT) represents participation in our bitcoin mining ecosystem. Regarding the “ballast in bitcoin and terahash”, it is worth saying that our project is guaranteed by the Bitcoins and the hash power we contribute. Each terahash is a unit that “produces” bitcoins, so not only does our token have bitcoins behind it, but also terahash. This terahash increases the amount of bitcoins constantly, which makes our token more ballast bitcoins and worth more every day.

Yes, fill out this interest form to get on the waiting list and be notified of the next tour date at one of the mining companies.

To predict profitability, you need to understand 3 factors:

1) Network difficulty: the network difficulty factor influences the mining result, because it determines how many bitcoins you will receive for each terahash contributed. The difficulty changes every 14 days and depends on how many miners are connected to the system (the more miners, the harder).

2) Hash power: the number and model of connected machines will give us a hash power, that is, a number of terahashes that would be a multiplication factor to know how many bitcoins we will produce, times the inverse of the difficulty (1/difficulty). Thus, Profit = Hash Power x (1/Difficulty). So the higher the hash power, the higher the profit (this result is a result in bitcoins).

3) Bitcoin value: the value of bitcoin changes every minute and basically, when the value is higher, we earn more dollars, on the other hand, when bitcoin is cheaper, we earn less dollars.

You can also check the profitability in our Investment Simulator, in our app.

In summary, there are two places where you can purchase AMTs: the AutoMiningToken MarketPlace and PancakeSwap. Both markets are decentralized, i.e. they are managed with smart contracts where we must connect our MetaMask wallet (download from the official site) and will allow us to trade directly from our wallet. By clicking on “trade” or “buy” the desired amount will be transferred to the platform and the corresponding AMT amount will be received immediately.

The dynamics of the Liquidity Pool are as follows: buying AMTs causes their price to rise automatically, managed by the liquidity pool’s internal algorithm. And the reverse is also true, in the case of a sale, the AMT price automatically drops. The relationship between one token and another will give us the value of the AMT.

In our app you can check the connected machines, as well as their terahash power and bitcoin production in the last 24 hours. There you will see a watcher link that will take you to the site of the pool the machines are connected to, so you can check it out right at the source.

These bitcoins are distributed to a wallet that can be checked on the blockchain website, online, in real-time. Initially, they go to a Bitcoin network wallet, then they pass through Binance to bridge to Binance SmartChain, and finally, they go to the project’s wallets, which are programmed with smart contracts. This wallet can also be checked (both the inputs and outputs) on the BSC website, where you can see with complete transparency in real-time the entire flow of the produced bitcoins.

First, because we are not a platform, and the difference is that users don’t have to send their money to anyone, they just have to buy the token. This token represents a stake in our mining ecosystem. The token can be purchased via PancakeSwap or on our website, and when you connect your MetaMask wallet the exchange is done automatically. Thus, both the money and the tokens remain in the custody of the user.

Payments are made through a programmed wallet with a smart contract. This wallet internally has an order to be executed every day with the bitcoins produced. The schedule cannot be changed and is public, it will be on the website www.bscscan.com. The smart contract is accessible to everyone. Each wallet has an identifier and that identifier is posted on the Binance Smart Chain website, and there we can see what her internal programming “says.” With this transparency, we assure the user that he will receive his bitcoins, and that this does not depend on the will of one person or company, it depends on what the smart contract is programmed to do.

The AMT is a synthetic token of bitcoins. This means that it is backed by bitcoins and can therefore be exchanged for bitcoins at any time – this is guaranteed by a smart contract. Thus, the token is worth an increasing amount of bitcoins every day. Then, if bitcoin increases in value, the token becomes even more valuable and profitable. The second incentive is that exclusive possession of AMT in a wallet causes the system to recognize it and pay out an amount of bitcoins proportional to the amount of AMT in the wallet relative to the total in circulation. I repeat, single possession, just by having AMT in your wallet, the system will capture the balance of all the wallets, and whoever has 1% of the tokens is awarded 1% of what is deposited in a wallet that we call “Daily Profit”.

If there is a big sell-off in the liquidity pool, this would cause a drop in the token’s price, arguably. Suppose something like this happens and the tokens are devalued by 50%, should that worry us? Well, no, because if before my AMTs generated a daily amount in bitcoin, what has happened now is that these AMTs that are for sale “at a discount” generate the same amount as they did before they were sold, because there are the same AMTs in circulation and there are the same number of machines generating bitcoins for the ecosystem. Then, whoever buys these AMTs would get double the benefit in relation to the capital contributed, an even better opportunity is created for a new investor. If I have a business that generates 1% per month and now that same business is put up for sale at half the price, but still generates the same profitability, it is an excellent opportunity, since with the same investment, 2% income per month would be generated.